This article is based on a multi-client study that was supported by the world’s major manufacturers and suppliers of security systems. This has enabled the development of a series of robust models that when populated with validated data can determine the performance and value of both the supply and demand side. It has allowed us to size, compare and trend numerous market segmentations, establish supplier performance in both product and systems business and establish the importance and effect of all the demand drivers. This report benefits from comparisons with similar studies carried out in different regions of the world and on related studies, environmental controls and Fire Detection studies that were carried out in parallel. Data on the past, present and future market for Intelligent Building Controls for access control, CCTV surveillance and intruder alarms, is clearly presented quantitatively and qualitatively, so that strategies can be developed to fully exploit opportunities on a pan-regional basis.

By Allan McHale

MAJOR DRIVERS

This is an exciting time for all those involved in the EU-CE(4)1) IBC(s)2) industry for this is a relatively immature business that it is about to undergo some rapid evolutionary, if not revolutionary, change. It has size, some Euro 218 million at installed prices and the potential to increase by half as much again within the next five years. But the supply side is fragmented and needs restructuring so that more companies can achieve the necessary minimum economic size to invest in IP Systems and Digital Technology and realise this latent potential. During the last three years major consolidation has taken place with the top global suppliers aggressively acquiring smaller but important players in the security business. However, this has not yet had a major impact on the CE(4) market and here in the next five years organic growth will have to play the major role in achieving rapid growth and increasing market share because there are few opportunities to acquire significant sized companies to this market.

CCTV VS. ACCESS CONTROL

German-based manufacturers of security products and systems are taking an important share of the Central Europe market particularly in the fast growing sectors of access control and CCTV surveillance and this is not surprising given their close proximity to these markets and cultural links that existed some eighty years ago.

|

|

|

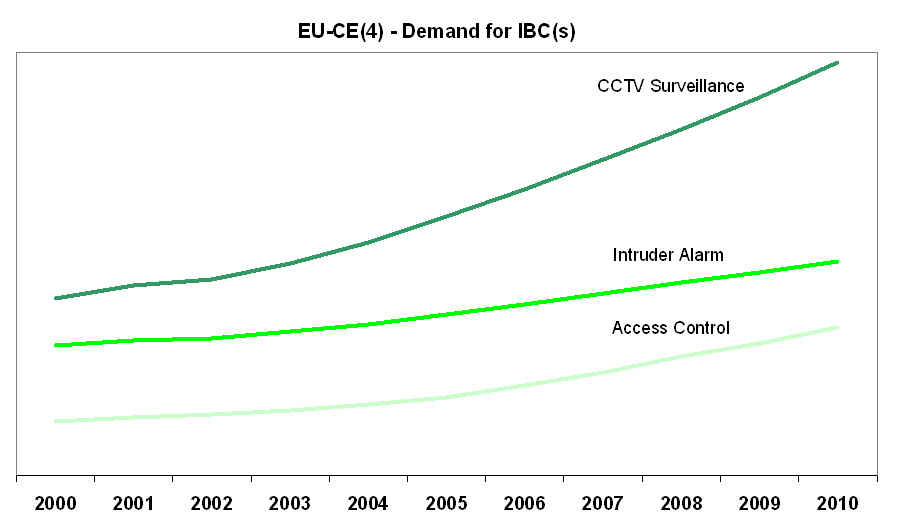

Figure 1. EU-CE(4) - Demand for IBC(s) (Source: i&i / Proplan) |

Figure 1 shows that the IBC(s) market has experienced solid growth across all CE(4) countries

averaging 5.5% in the last five years. The total IBC(s) systems market in 2005 was worth £218 million and of this IBC(a)3) at £40 million accounted for 18%, IBC(c)4) at £108 million shared 49% and the balance of 32% was IBC(i)5) business which contributed sales of £71 million. We forecast that in 2006 aggregate growth of IBC(s) sales in Central Europe would be 8.1% whilst the compound annual growth rate up to the end of the decade would be 7.9%. Poland is the largest market having 40% of the IBC(s) market at £88 million, followed by the Czech Republic at £70 million (32%) and then Hungary at £34.1 million (16%) and Slovakia at 25.9 million (12%). The chart does show, however, that there has been a wide variation in growth with the CCTV Surveillance business well outperforming the Access Control and Intruder Alarms markets. CCTV will continue its growth pattern for the next five years across all four countries. Access Control has disappointed in the last five years but it is set to take-off and it will narrow the gap between itself and Intruder Alarms during the next five years.

MARKET PENETRATION

|

.jpg)

|

|

Figure 2. Central Europe - Penetration Performance of IBC(s) Sales (Source: i&i/ Proplan) |

Figure 2 shows that apart from the Czech Republic the market penetration that IBC(s) has

achieved in each of the other three countries Poland, Hungary and Slovakia is very small compared with the average for Western Europe. This study shows that further growth through penetration is there to be taken and the adoption of the new technologies will hasten this process provided that the distribution channels are trained to a higher professional standard. The Czech Republic has performed quite well having a penetration level of some three times that of Poland and shows what can be achieved in the other 3 countries.

This is a very robust market for some 50% of all sales in the two largest markets of Poland and the Czech Republic is for the refurbishment, retrofit, replacement and extension business. Strong demand has not reduced competitive pressures, as cheaper products are imported from China and the Far East but this has relaxed somewhat this year compared with the earlier part of this decade. The major drivers at this time are growth and stability in the economy and the building construction market. Public concern over crime and terrorism and the political willingness to address these issues has not been a major demand driver in the last five years. However these issues will become much more important during the next five years.

HIGHLY FREAGMENTED

One of the most surprising and striking features of this market is that despite major consolidation taking place over the last five years, it is still a very fragmented market. There are a few relatively big suppliers but none that have a monopoly in any of the three businesses across the EU-CE(4). No one manufacturer supplier takes more than 12% of the product business and the top five suppliers take no more than 16% of the systems business. The biggest part of the systems market is shared by hundreds of small VARs with the majority having less than 1% of the business and only supplying one country market.

WHAT’S CAUSING CHANGE

The study shows that there are four prime forces causing change, in the IBC(s) business, IT-Convergence, Price Pressures and resultant changes in the Supply Structure, Technology, Communications and Standards. These forces are obliging manufactures to adopt new strategies. In particular we believe that few IBC(s) suppliers have yet taken on-board the full implications of IT-Convergence and the fact that they need to adopt strategies that embody alliance and specialisation if they are to win through delivering performance and value to building owners. Competitors from outside the industry particularly those from the IT Networks markets see the opportunities provided by integration through IT-Convergence to deliver total building solutions and they will provide a serious challenge to the IBC(s) suppliers and this is already being evidenced in Poland. Here, a number of IT-Network suppliers are active in providing a full System Integrator service not just for Security Management Systems but linking into the Business Enterprise. They appreciate that IP-based systems can improve the performance and value of the security system and they are in a strong position to influence the CIO who is their regular client that they can deliver.

One of the major vertical markets in Central Europe is the construction refurbishment and expansion of Airports. They are experiencing a real boom period not only in terms of passenger traffic but also major investment in new terminals and runways. The study just completed by I & I Proplan shows that the transport sector accounts for some 7% of all investments in intelligent building services infrastructures in non domestic buildings. In 2005 it invested some £30 million at installed prices in Access Control CCTV, Intruder Alarms, Fire Detection and Environmental Control Systems and it is forecast to grow at 9/10% per annum over the next five years. The major Markets are in Poland and the Czech Republic for they accounted for some 70% of the business in 2005.

|

Endnotes

1) EU-CE(4) includes, Czech Republic, Hungary, Poland and Slovakia.

2) Intelligent Building Controls for access control, CCTV surveillance and intruder alarms

3) Electronic devices and systems to control and monitor people through secured access points such as doors

4) The use of CCTV for security applications in buildings and public places and traffic management

5) Electronic sensors and systems that can detect intruders entering premises and sites and signal alarms

|

Allan McHale, a Chartered Mechanical and Energy Engineer, held a number of techno commercial management posts in energy related industries before joining Sema-Metra Consulting as a senior consultant in the London office, subsequently being seconded as European Sales & Marketing Director to a major American Corporation. In 1980 McHale formed ProPlan (www.proplan.co.uk), now a division of i&i limited (www.iandi.ltd.uk), to provide market intelligence to manufacturers of intelligent infrastructures for buildings.

For more information, please send your e-mails to swm@infothe.com.

ⓒ2007 www.SecurityWorldMag.com. All rights reserved.

|