By Allan P McHale

The speed of innovation in the physical security industry is faster than any one supplier can possibly achieve or fund by themselves. In addition technology is being imported from the electronics, computer and IT industries all requiring new areas of expertise and developing this internally is just not practical in the short term. This is why new alliances and partnerships are occurring, between these businesses and the security industry. But to leverage the research and development costs there is a need to rapidly scale up and establish a global presence and this can be best achieved through or by the acquisition of those companies that have either the technology or the distribution networks in place.

BUSINESS VALUE OF TECHNOLOGY

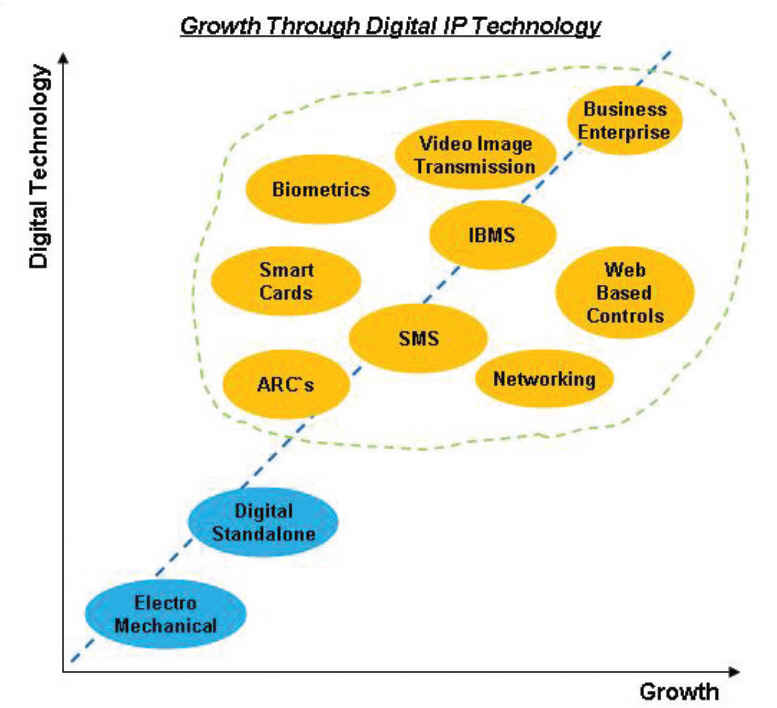

Back in 2001, as part of a detailed review on the industry, I illustrated in Figure 1 how growth in the business will be inextricably linked with the rapid uptake of digital technology. I said, “For it is digital technology that will provide the opportunity to produce products and systems that will meet customer demands for more secure, safe, flexible and productive working environments and drive forward growth. For those who quickly meet the challenge, it will lead to higher margins and rates of growth in both the product and total solutions business.”

While those specializations within the dotted lines would now be called IP technology and some of the terminology may now have been replaced some eight years later the chart is still very applicable. I commented then that the implication here was that few would have the time or resources to invest in this new technology and that serial acquisition of smaller players would take place accompanied with alliance in special areas.

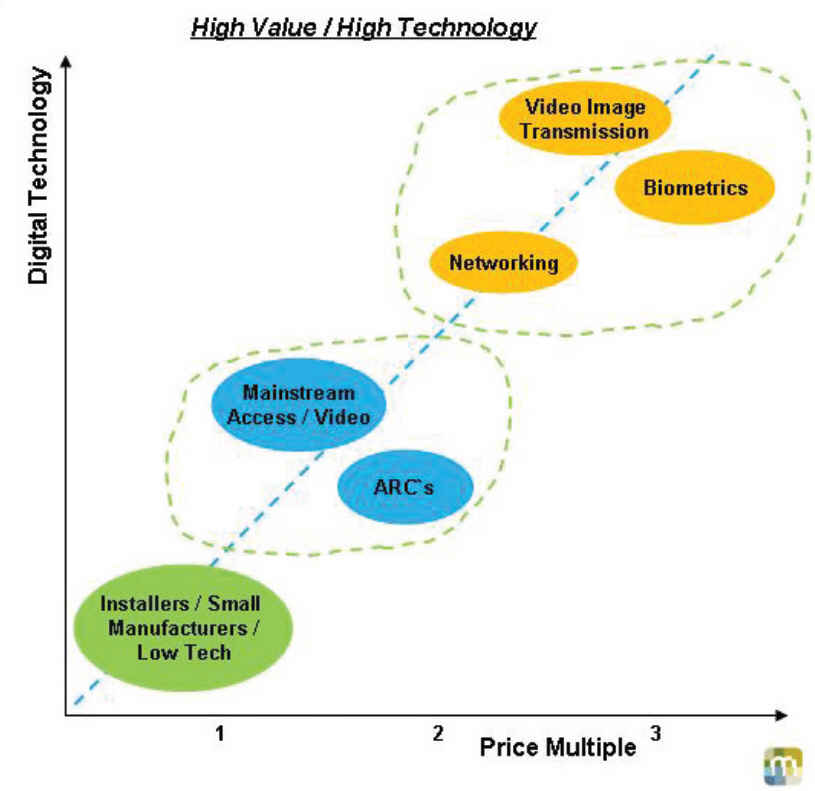

Now let’s refer to Figure 2. This shows the exit selling multiples for different types of security companies. If you superimposed this onto Figure 1, it would almost fit exactly. Higher growth higher technology companies sell for higher prices than companies installing systems or manufacturing standard products. This is hardly surprising but the difference in value is quite remarkable for relatively small companies in the biometrics field or IP video are selling for 3 times exit sales, while installers at an order of magnitude larger are selling at parity. The difference is not so much conditioned by higher margins and profitability although those factors do apply, but about much higher rates of growth and less competition through advanced high tech products and integrated solutions.

One of the most powerful indicators shown through these charts is the correlation between high value benchmarks and the capability and adoption of leading-edge technology of the target/acquired company. Some will argue that the buyer is paying too much but if you check out L-1 Identity Solutions who have acquired around 10 companies having biological identity solutions in recent years, they are a very profitable operation working on high margins and their profitability has not been impaired by paying high multiples.

Figure 1. Correlation between growth in the business and the uptake of digital technology (Source: Proplan/BSRIA)

Figure 2. Higher growth higher technology companies sell for higher prices than companies installing systems or manufacturing standard products. (Source: Memoori)

IMPACT OF CREDIT CRUNCH

There are a plethora of new companies that have entered the video image transmission and intelligent surveillance software market during the last few years many of these new start operations are based in California and Boston environs in the U.S.A. and despite their small size they have attracted experienced top quality engineers and managers having a share in the equity. At this time venture capital companies have been very keen to invest in them, but will the credit crunch stop the flow of capital?

There has been a slowing down in the consolidation process in the last six months and without doubt this has been caused by the effects of the worldwide credit crunch. The majors in the business have strong balance sheets and no restrictions on financing suitable acquisitions but medium and small companies will find it more difficult to finance acquisitions and this will also apply to management buyouts.

In addition we have now entered a worldwide recession and despite the fact that demand for security equipment is currently holding up well, particularly in the IP video business, small companies will find it increasingly difficult to get access to new capital to finance their development. I expect, therefore, that during the second half of 2009 there will be a resurgence in both acquisition and merger activity. Undoubtedly the growth in demand for security equipment will decline but we expect that annual growth next year will still remain a healthy 3-5% across the board and double this in the IP video market. While cash has contributed the major share of the purchasing mix in the last five years more deals in the future will need to be done using the acquirer’s stock. One thing is certain there will be no part for leveraged buyout, not that they have played a significant role in this industry to date.

FUTURE PROSPECT

Acquisition activity is taking place right across all applications but video surveillance has made the largest number of deals followed by access control and then intruder alarms. IP video is currently the star when taking into account the issue of IPOs and influx of seed capital. I have identified approximately 100 companies in various aspects of analytical software IP cameras and communication software and hardware that have entered the business since 2000 with the majority in the U.S.A. being no more than 3 years old. Israel is another country punching well above its weight when it comes to innovation in security technology. The future continues to look bright but it is inevitable that growth will slow down.

How this will affect the consolidation process remains to be seen because the credit crunch as I have shown could have a negative or positive spin on the process. The majors in the business have strong balance sheets and no restrictions on financing suitable acquisitions but medium and small companies will find it more difficult to obtain finance and this will also apply to management buyouts. One thing is certain and that is that the future will be more challenging than the past for all suppliers in this market.

Allan P McHale is Director of Memoori, Ltd. (www.memoori.com/reports.jsp).

For more information, please send your e-mails to swm@infothe.com.

ⓒ2007 www.SecurityWorldMag.com. All rights reserved. |